Porter’s Five Forces Analysis

Introduction

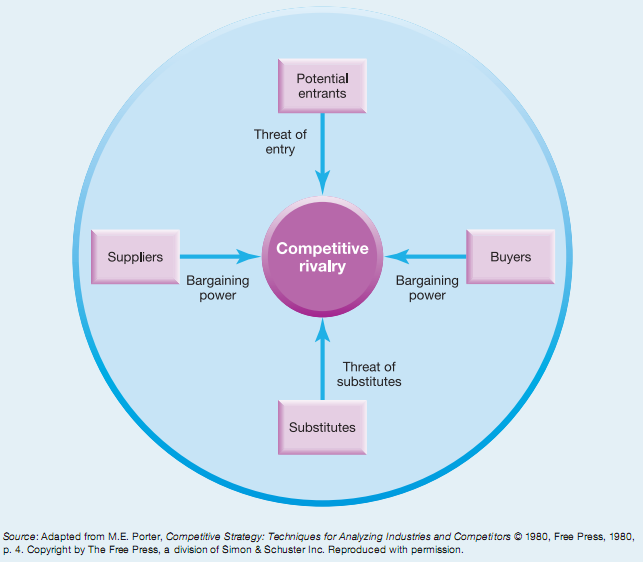

Introduced more than thirty years ago by Professor Michael Porter of the Harvard Business School, five forces analysis has long been and remains perhaps the most popular analytical tool in the business world for industry analysis.

(Figure Porter’s Five Forces model – “Industry Analysis”).

The Purpose of Five Forces Analysis

Visit the executive suite of any company and the chances are very high that the chief executive officer and her vice presidents are relying on five forces analysis to understand their industry

The purpose of five forces analysis is to identify how much profit potential exists in an industry.

To do so, five forces analysis considers the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers.

If none of these five forces works to undermine profits in the industry, then the profit potential is very strong.

If all the forces work to undermine profits, then the profit potential is very weak. Most industries lie somewhere in between these extremes. This could involve, for example, all five forces providing firms with modest help or two forces encouraging profits while the other three undermine profits.

Once executives determine how much profit potential exists in an industry, they can then decide what strategic moves to make to be successful. If the situation looks bleak, for example, one possible move is to exit the industry.

Elements / Components of Five Forces Analysis

-

The Rivalry among Competitors in an Industry

The competitors in an industry are firms that produce similar products or services. Competitors use a variety of moves such as advertising, new offerings, and price cuts to try to outmaneuver one another to retain existing buyers and to attract new ones. Because competitors seek to serve the same general set of buyers, rivalry can become intense

Understanding the intensity of rivalry among an industry’s competitors is important because the degree of intensity helps shape the industry’s profit potential. Of particular concern is whether firms in an industry compete based on price. When competition is bitter and cutthroat, the prices competitors charge—and their profit margins—tend to go down. If, on the other hand, competitors avoid bitter rivalry, then price wars can be avoided and profit potential increases.

Industry concentration is an important aspect of competition in many industries. Industry concentration is the extent to which a small number of firms dominate an industry.

Among circuses, for example, the four largest companies collectively own 89 percent of the market. Meanwhile, these companies tend to keep their competition rather polite. Their advertising does not lampoon one another, and they do not put on shows in the same city at the same time. This does not guarantee that the circus industry will be profitable; there are four other forces to consider as well as the quality of each firm’s strategy. But low levels of rivalry certainly help build the profit potential of the industry.

2. The Threat of Potential New Entrants to an Industry

Competing within a highly profitable industry is desirable, but it can also attract unwanted attention from outside the industry. Potential new entrants to an industry are firms that do not currently compete in the industry but may in the future.

New entrants tend to reduce the profit potential of an industry by increasing its competitiveness.

If, for example, an industry consisting of five firms is entered by two new firms, this means that seven rather than five firms are now trying to attract the same general pool of customers. Thus executives need to analyze how likely it is that one or more new entrants will enter their industry as part of their effort to understand the profit potential that their industry offers.

New entrants can join the fray within an industry in several different ways. New entrants can be start-up companies created by entrepreneurs, foreign firms that decide to enter a new geographic area, supplier firms that choose to enter their customers’ business, or buyer firms that choose to enter their suppliers’ business.

Barrier to entry

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that new entrants will join an industry.

New entry is less likely, for example, to the extent that existing competitors enjoy economies of scale (because new entrants struggle to match incumbents’ prices), capital requirements to enter the industry are high (because new entrants struggle to gather enough cash to get started), access to distribution channels is limited (because new entrants struggle to get their offerings to customers), governmental policy discourages new entry, differentiation among existing competitors is high (because each incumbent has a group of loyal customers that enjoy its unique features), switching costs are high (because this discourages customers from buying a new entrant’s offerings), expected retaliation from existing competitors is high, and cost advantages independent of size exist.

3.The Threat of Substitutes for an Industry’s Offerings

Executives need to take stock not only of their direct competition but also of players in other industries that can steal their customers.

Substitutes are offerings that differ from the goods and services provided by the competitors in an industry but that fill similar needs to what the industry offers .

How strong of a threat substitutes are depends on how effective substitutes are in serving an industry’s customers.

At first glance, it could appear that the satellite television business is a tranquil one because there are only two significant competitors—DIRECTV and DISH Network. These two industry giants, however, face a daunting challenge from substitutes. The closest substitute for satellite television is provided by cable television firms, such as Comcast and Charter Communications. DIRECTV and DISH Network also need to be wary of streaming video services, such as Netflix, and video rental services, such as Redbox. The availability of viable substitutes places stringent limits on what DIRECTV and DISH Network can charge for their services. If the satellite television firms raise their prices, customers will be tempted to obtain video programs from alternative sources. This limits the profit potential of the satellite television business.

The dividing line between which firms are competitors and which firms offer substitutes is a challenging issue for executives.

4.The Power of Suppliers to an Industry

Suppliers provide inputs that the firms in an industry need to create the goods and services that they in turn sell to their buyers. A variety of supplies are important to companies, including raw materials, financial resources, and labor .

The relative bargaining power between an industry’s competitors and its suppliers helps shape the profit potential of the industry.

If suppliers have greater leverage over the competitors than the competitors have over the suppliers, then suppliers can increase their prices over time. This cuts into competitors’ profit margins and makes them less likely to be prosperous.

On the other hand, if suppliers have less leverage over the competitors than the competitors have over the suppliers, then suppliers may be forced to lower their prices over time. This strengthens competitors’ profit margins and makes them more likely to be prosperous.

Thus when analyzing the profit potential of their industry, executives must carefully consider whether suppliers have the ability to demand higher prices.

5.The Power of an Industry’s Buyers

Buyers purchase the goods and services that the firms in an industry produce For Subway and other restaurants, buyers are individual people. In contrast, the buyers for some firms are other firms rather than end users. For Procter & Gamble, for example, buyers are retailers such as Walmart and Target who stock Procter & Gamble’s pharmaceuticals, hair care products, pet supplies, cleaning products, and other household goods on their shelves.

The relative bargaining power between an industry’s competitors and its buyers helps shape the profit potential of the industry.

If buyers have greater leverage over the competitors than the competitors have over the buyers, then the competitors may be forced to lower their prices over time. This weakens competitors’ profit margins and makes them less likely to be prosperous.

Walmart furnishes a good example. The mammoth retailer is notorious among manufacturers of goods for demanding lower and lower prices over time.

In 2008, for example, the firm threatened to stop selling compact discs if record companies did not lower their prices. Walmart has the power to insist on price concessions because its sales volume is huge. Compact discs make up a small portion of Walmart’s overall sales, so exiting the market would not hurt Walmart. From the perspective of record companies, however, Walmart is their biggest buyer. If the record companies were to refuse to do business with Walmart, they would miss out on access to a large portion of consumers.

On the other hand, if buyers have less leverage over the competitors than the competitors have over the buyers, then competitors can raise their prices and enjoy greater profits. This description fits the textbook industry quite well. College students are often dismayed to learn that an assigned textbook costs $150 or more. Historically, textbook publishers have been able to charge high prices because buyers had no leverage. A student enrolled in a class must purchase the specific book that the professor has selected.

Used copies are sometimes a lower-cost option, but textbook publishers have cleverly worked to undermine the used textbook market by releasing new editions after very short periods of time.

order prescription medicine online without prescription

Some truly quality articles on this website , saved to favorites.

buy prednisone online without a script: can you buy prednisone over the counter in canada – no prescription prednisone canadian pharmacy

https://clomidsale.pro/# can i buy cheap clomid

buy cytotec over the counter Misoprostol 200 mg buy online buy cytotec online fast delivery

vipspark.ru

That is very interesting, You are an excessively skilled blogger.

I have joined your rss feed and look ahead to in quest of

more of your magnificent post. Also, I’ve shared your site

in my social networks

batmanapollo.ru

fump.ru

fump.ru

ブランドコピーiphone

Laptop Bags For Women

Cast Iron Tea Cups

I do not even understand how I ended up right here, however I assumed this submit was good.

I don’t recognise who you are however definitely you’re going to

a well-known blogger in the event you aren’t already. Cheers!