The Negotiable Instruments Act, 1881

Negotiable instruments are the most common credit devices utilized in business society. Negotiable instruments importance lies in the fact that these are more readily transferred than ordinary claims or contract rights that the transferee of a negotiable instrument may acquire greater rights than would an ordinary assignee. Though basically, negotiable instruments are written promises or orders to pay money, such as promissory notes, bills of exchange and cheques which when in proper form, may be transferred from person to person as a substituted of money.

The Negotiable Instruments Act was passed in 1881. Some provisions of the Act have become redundant due to passage of time, change in methods of doing business and technology changes. However, the basic principles of the Act are still valid and the Act has stood test of time. The Act extends to the whole of India. There is no doubt that the Act is to regulate commercial transactions and was drafted to suit requirements of business conditions then prevailing.

The instrument is mainly an instrument of credit readily convertible into money and easily passable from one hand to another.

Meaning of Negotiable Instruments

According to section 13 (a), Negotiable Instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer, whether the ‘words’ order or ‘bearer’ appear on the instrument or not. Any other instrument can be added to these three if it satisfies two conditions of negotiability. One is that it is by customs of trade transferable by delivery or by endorsement and delivery; second is that it is capable of being sued upon by the person holding out in his own name.

The nature of negotiable instrument is such that property in it is acquired by every person who takes it bonafide and for value, notwithstanding any defect of title in the person from whom he took it. On this basis a negotiable instrument may be defined as a contractual obligation in writing and signed by the party executing it, containing an unconditional promise or order to pay a sum certain in-money on demand, or at a fixed or determinable future time, payable to bearer or to the order of a specified person.

Characteristics:

- Freely transferable from one person to another

- Title holder for a valid reason is free from all defects

- The holder in due course can sue in his own name for the recovery of the amount there on.

- Presumptions: a) Consideration: it should have been transferred for consideration b) Date: it must be dated c) Time of acceptance: should be accepted within a reasonable period of time d) Time of transfer: before maturity to be effective e) Stamp: properly stamped f) Holder presumed to be a holder in due course

- A negotiable instrument must be in writing, which includes typing, printing and engraving.

- The instrument must be signed by the maker or drawer.

- There must be a promise if it is a promissory note or order to pay if it is a bill of exchange.

- The promise or order must be unconditional. If it is conditional the instrument is not negotiable.

- A negotiable instrument must call for payment in money. If the promise or order is for anything else, the instrument is not negotiable.

- The instrument must not only call for payment in money but also for a certain sum.

- In the case of a bill of exchange or cheque, the drawee must be named or described with reasonable certainty. The purpose of this requirement is to enable the holder of the instrument to know to whom he must go for payment.

PROMISSORY NOTE (Sec. 4)

Promissory note is defined by Section 4 of the Negotiable Instruments Act. A promissory note is an instrument in writing containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

A “promissory note” is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument. [Section 4].

An instrument to be a promissory note must possess the following elements :

(1) It must be in writing: Mere verbal promise to pay will not do. The method of writing is important, but it must be in a media that can not be altered easily.

(2) It must contain an express promise or clear undertaking to pay: A promise to pay cannot be inferred; it must be express. A mere acknowledgement is not enough. The following are not promissory notes, as there is no promise to pay:

(b) “I am liable to pay you Rs. 1,000”.

(c) “I have taken from you Rs. 150; whenever you ask for it; I have to pay”

But the following is a promise to pay:

(a) “I promise to pay Ram or order Rs.1,500.”

(b) “Ram, I owe you Rs. 1,500 and promise to pay the same for value received.”

Although the promise to pay may be opposed to public policy and unenforceable, once a promissory note is executed the promise to pay is performed because a promissory note amounts in law to payment and what vitiates a promise does not vitiate a payment.

(3) The promise to pay must be unconditional: We have seen before that an instrument, to be negotiable, must contain an unconditional promise or order. So a promise to pay contained in a note must be unconditional. A conditional undertaking destroys the negotiable character of an otherwise negotiable instrument. But a promise to pay at a particular place or after a specified time or on the happening of an event which must happen is not conditional.

(4) The maker must Sign the promissory note: The person who draws the instrument and signs it is known as the maker and the person to whom the promise is made is called the payee. The instrument will be complete only when it is signed by the maker even when it is written by him and his name appears in the body of instrument. Signature may be in any part of the instrument, and may be expressed by a thumb mark or any other mark, if the executant is illiterate.

(5) The maker must be a certain person: The note itself must show clearly who is the person engaging himself to pay, Where the promisors are more than one they may bind themselves jointly or jointly and severally but not in the alternative.

(6) The payee must be certain: A promissory note must contain a promise to pay to some person or persons ascertained by name or designation or to their order. A promissory note made payable to the maker himself it nullity but if such a note is endorsed by him, it becomes payable to bearer and is valid.

(7) The sum payable must be certain and the amount must not be capable of contingent additions or substractions. Thus, if A promises to pay Rs.500 and all other sums which shall become due to him or to pay 180 and all fines according to rules, the instrument is not a promissory note.

(8) Payment must be in legal money of the country. Thus an agreement to pay money or grain or to deliver 100 tons of iron is not a promissory note.

(9) A bank note or a currency note is not a promissory note within the meaning of this section. They are expressly excluded from the definition, as they are treated as money and not merely securities for money. A promissory note or a draft cannot be made payable to bearer, no matter whether it is payable on demand or after a certain period.

(10) Other matters of form like number, place, date etc., are usually found given in notes, but they are not essential in law.

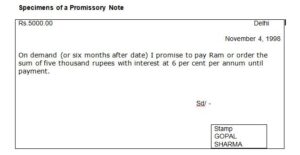

Specimens of a Promissory Note

| Rs.5000.00 Delhi November 4, 1998

On demand (or six months after date) I promise to pay Ram or order the sum of five thousand rupees with interest at 6 per cent per annum until payment. Sd/ –

|

Gopal is maker and Ram is the payee.

A promissory note must bear the stamp duty as required under the Indian Stamp Act. It is better if the stamps affixed al-e cancelled by the maker’s signature. Suit can not be maintained on an unsufficient stamped promissory note.

BILL OF EXCHANGE

According to Section 5 of the Negotiable Instruments Act, A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the Instrument. The definition of Bill of Exchange is very similar to that of a promissory note and for most purposes the rules which apply to notes are in general applicable to bills. The fundamental ingredients are the same. The drawer like the makers must be certain, the order to pay must be unconditional, the amount of Bill and the payee and the drawer, must be certain and the contract must be in writing. The maker of a note corresponds to the acceptor of a bill, and when a note is endorsed it is exactly similar to a bill, for then it is an order by the endorser of the note upon the maker to pay the endorsee. The endorser is, as it were, the drawer, the maker, the acceptor and the endorsee is the payee. But a bill differs from a note in some particulars.

As per statutory definition, “bill of exchange” is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument. [Section 5]. A cheque is a special type of Bill of Exchange. It is drawn on banker and is required to be made payable on demand.

The usual form of a bill of Exchange is given below:

| Rs.7000.00 Delhi

November 4, 1998 Three months after date pay to me or Bearer/or order the sum of rupees seven thousand only for value received. To SURYA SINGH Esplanade Road, Delhi

|

Here Sultan Singh is the drawee and X Y Z is the drawer or maker of the bill.

Essentials of a Bill of Exchange

- It must be in writing and may be in any language.

- It must be an order to pay by the drawer to the drawee.

- The order to pay must be unconditional. If the order to pay is conditional, the bill of exchange becomes invalid.

- There are three parties in a bill of exchange.

(a) Drawer: The person who makes the bill.

(b) Drawee: The person who is ordered to pay or on whom the bill is drawn.

(c) Payee: The person who is to receive the payment.

- The bill must be signed by the drawer otherwise it will become an inchoate instrument.

- The order to pay must be of a certain sum and it must be in money only.

- The payee and drawee must be certain.

- It must be properly stamped under the Indian Stamp Act.

Distinction between Bill and Note

The below given differences are enumerated from the above meanings of both the

instruments—

(1) In a note there are only two parties – the maker and the payee. In a bill there are three parties namely, drawer, drawee, and payee; though two out of three capacities may be filled by one and the same person. In a bill the drawer is the maker who orders the drawee to pay the bill to a person called the payee or to his order. When the drawee accepts the bill he is called the acceptor.

(2) A note cannot be made payable to the maker himself, while in a bill the drawer and payee or drawee and payee may be the same person.

(3) A note contains an unconditional promise by the maker to pay to the payee or his order; in a bill there is an unconditional order to the drawee to pay according to the drawer’s directions.

(4) A note is presented for payment without any prior acceptance to the maker. A bill payable after sight must be accepted by the drawee or some one else on his behalf before it can be presented for payment.

(5) The liability of the maker of a note is primary and absolute, but the liability of the drawer of a bill is secondary and conditional. He will be liable only if the bill is not accepted or paid by the drawer.

(6) The maker of the note stands in immediate relation with the payee. while the maker or drawer of an accepted bill stands in immediate relation with the acceptor and not the payee.

(7) Foreign bills must be protested for dishonour when each protest is required to be made by the law of the country where they are drawn but no such protest is necessary in the case of the note.

(8) When a bill is dishonoured, due notice of dishonour is to be given by the holder to the drawer and the intermediate indorsers, but no such notice need be given in the case of a note .

Types of Bill of Exchange

A bill of exchange may be an Inland bill or a Foreign bill. Originally, bill was a means by which a trader in one country paid a debt in another country without the transmission of coin. An Inland bill is drawn and payable in India or drawn in India upon some person resident in India, even though it is made payable in a foreign country. A bill which is not Inland is a Foreign Bill (Sec. 12).

Accommodation Bill

Legitimately speaking, an accommodation bill is not a bill as such. It is simply a mode of accommodating a friend in business. For example, A may be in want of money and approach his friend B and C who, instead of lending the money directly, propose to draw an ‘Accommodation Bill’ in his favour. A promises to reimburse C before the period of the bill is up (which is generally 3 months). If the credit of B and C is good, this device enables A to get an advance from his banker at the commercial rate of discount. The real debtor in this case is not C, the acceptor, but A the payee who has engaged to find the money for its ultimate payment, and A is here the principal debtor and the others merely sureties. Thus, as between the original parties to the bill the one who would prima facie be principal is in fact, the surety whether he be drawer, acceptor or indorser, that bill is an accommodation bill.

Cheques: A “cheque” is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand. ‘Cheque’ includes electronic image of a truncated cheque and a cheque in electronic form [Section 6]. The definition is amended by Amendment Act, 2002, making provision for electronic submission and clearance of cheque. The cheque is one form of Bill of Exchange. It is addressed to Banker. It cannot be made payable after some days. It must be made payable ‘on demand’.

HUNDI

As stated earlier in this chapter, the negotiable instrument act covers only three types of instruments, viz. promissory note, bill of exchange and cheque. Hundi is not given in the definition of a negotiable instrument in the act. Hundi is one of the oldest instrument prevalent in Indian business world. Hundis are governed by local usages or customs but where the act is contrary to the customs, the local usages or customs will apply. But in the absence of any usages or customs, the provisions of this act will apply.

The word Hundi is derived from the Sanskrit word ‘Hund’, which means to ‘collect’.

Hundi is generally drawn in a vernacular language according to Indian mercantile common law and customs. It is sometimes drawn as a promissory note.

Sometimes, a hundi is accompanied by ZIKRI CHIT. The zikri chit is written by the

drawer or any other prior party and addressed to some respectable person requesting him to honour-the hundi if it is dishonoured for non-payment or for any other reason. Thus it serves as a letter of protection.

Types of hundis

- Darshni Hundi : It is payable at sight or on demand. No days of grace are allowed.

- Nam Jog Hundi : It is payable to the person named in it or to his order. It is also called as ‘farmanjog hundi’. It can be negotiated by endorsement and delivery alone like a bill of exchange.

- Muddati Hundi : It is payable after the expiry of a fixed period. Days of grace are allowed as per local customs .

- Jawabi Hundi : The person who has to remit the money writes a letter to the payee.

The payee directs him to make the payment on his order. Once the payee has obtained payment after the arrival of the letter, he sends his reply (jawab) for the receipt of payment.

Through this method money can be passed on from one place to another place. For example, Anand in Delhi owes Rs. 10,000 to Bihari in Kanpur, Rarn in Meerut owes Rs.10,000 to Anand in Delhi, Ram wants to make payment to Anand. Anand writes to Ram directing him to make payment to Bihari and send the ‘jawab’ intimating him the payment to Bihari. Similarly Bihari is also requested to send reply soon after he is paid by Ram.

- Shah Jog Hundi : The word shah means a person of repute and wealth. This hundi is an instrument payable to bearer, negotiable by delivery alone and payable only to a shah. A shah Jog hundi passes from person to person by delivery only, sirlce no endorsement is needed. The shah after making due enquiries regarding its validity will present it to drawee for final settlement. In case of any fraud, the shah is bound to refund the amount of hundi with interest.

- Dhanijog Hundi : It is payable to the holder or to the bearer but the payer must ensure that its payment is being made to the real owner of hundi.

- Nishanjog Hundi : Where the drawer does not write the name of the payee but simply parts a private code on the hundi which a drawee should decipher before making payment. This is payable only when the payee produces a person to the drawee who identifies the payee.

- Jokhmi Hundi : It is drawn by the seller upon the buyer in lieu of the price of goods sold. The buyer accepts it for payment conditional upon the receipt of goods bought. It is some sort of combination of bill of exchange and insurance policy. Strictly speading it can not be placed in the category of a negotiable instrument because it is conditional.

- Khoti Hundi : It is a hundi whose genuineness is in doubt or which is a forged one.

- Khoka Hundi : It is a hundi whose amount has been paid.

CHEQUES

A cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand. It is like a bill of exchange always drawn on a bank payable on demand. Therefore, it must satisfy all the requirements of a bill (section 6).

It must be in writing and signed by the drawer. It should contain an unconditional order to a specified banker to pay a certain sum of money to a particular person or to his order or to the bearer on demand.

Distinction between Bills and Cheques

- A cheque is always drawn on a banker, while a bill may be drawn on anyone, including a banker.

- A cheque’s payment is made when it has been demanded whereas in case of a bill its nature may be such that payment has to be made on demand or after the expiry of a certain period after date or sight.

- In case of a cheque a bearer can get payment on demand but a bill’s payment can not be demanded by the bearer.

- Acceptance of bill is necessary for the demand of its payment, in case of cheque

acceptance is not required and is aimed for quick payment.

- In case of bills ordinarily a provision for grace days is made (which is generally of 3 days) whereas in case of cheques no such grace is allowed.

- In the absence of presentment of a bill for payment the liability of bill’s drawer

ceases, whereas liability of cheque’s drawer ceases when the delay caused in presentment for payment results in damages.

- Notice must be served when the bill is dishonoured, but when a cheque is not honored, no such notice is necessary.

- A cheque being a revocable order the authority may be revoked by countermanding payment, and is determined by notice of the customer’s death or insolvency. In case of a bill the position is different, it can not be revoked.

- A cheque may be crossed to secure its payment, no such crossing can be done in case of a bill.

Liability of a Banker

A banker is one whose business is to honour cheques drawn upon him by persons and for whom he receives money on current accounts. If a person opens a current account by depositing certain money with the banker, a relationship of creditor and debtor emerges between the customer and the banker and the banker undertakes to honour the cheques drawn by the customer so long it has sufficient funds to the credit of the customer. If a banker without justification, fails to obey his customer’s mandate which is issued in the form of a cheque, he will be liable to compensate the drawer for any loss or damage suffered by him.

But the payee or the holder of the cheque has no cause of action against the banker as the obligation to honour cheques is only towards the drawer.

The customer may, however, be awarded very heavy damages, if he proves loss of credit on account of the dishonour, and the rule is the smaller the amount of a cheque dishonoured the larger the amount the damages.

There are numerous cases in which the banker must refuse to honour his customer’s cheques:

- When customer countermands payment. When a customer after issuing a cheque, issues instructions not to honour a cheque, the banker must not pay it. If the bank pays it, he will be liable to make good the customer’s loss.

- When banker receives notice of customer’s death. Notice of customer’s death terminates banker’s authority to honour cheques.

- When customer becomes insolvent. When a customer has been adjudged an insolvent, all his assets vest in the Official Assignee or the Court, and the banker must thereafter refuse to pay his cheques.

- When banker receives notice of customer’s insanity, he must not honour his cheques.

- When the banker receives a garnishee order from the court relating to the customer’s money, the banker should not honour cheques drawn against the customer’s account.

- The banker should not honour his customer’s cheques after the customer has given notice of assignment of the credit balance of his account.

- When the holder’s title is defective, and banker comes to know of the defect.

- When the banker comes to know that the customer is drawing cheques for unlawful purposes.

- When the banker has received a notice from the customer for closing the account.

When banker may refuse payment. In the following cases the banker may, if he likes, refuse to honour the cheques :

- Where the cheque is post-dated and is presented before the date noted on it. The banker is required to pay the cheque on the date which the cheque bears and not before. In fact, payment before that date is made by the banker at his own risk, for if the customer countermands payment or issues another cheque bearing an earlier date, the banker cannot debit the customer’s account with the amount of the post-dated cheque.

- Where the banker has not got sufficient funds of the drawer with him.

- Where the funds in the hands of the banker are not properly applicable to the payment of the customer’s cheque. For example, the funds are held by the customer in trust, and the cheque is issued in breach of trust, the banker may refuse to pay.

- Where the cheque is of doubtful legality. The banker may refuse to pay if the cheque is irregular or ambiguous, materially altered or drawn in a doubtful legality.

- Where the cheque is presented after office hours.

- Where the cheque is presented at a branch where the customer has no account or where his account is overdrawn.

- Where some persons have joint account and the cheque is not signed by all jointly,

or by the survivors of them. But if the cheques are payable to Either or survivor then the chrque signed by any of the two parties will be sufficient for payment.

- Where the cheque has been allowed to become stale, i.e., it has not been presented for payment within a reasonable time after the date mentioned in it. In India, a cheque presented 6 months or more after the date is regarded as state.

Crossing of Cheques

A cheque is either an “Open cheque” or a “crossed cheque”. An open cheque is uncrossed and can be presented by the payee to the banker on whom it is drawn and will be paid over the counter. An open cheque is, however, liable to great risk in course of circulation. It may be stolen or lost and the finder may get it cashed. In order to avoid the losses incurred by open cheques getting into the hands of wrong parties the custom of crossing was introduced.

A Crossing is a direction to the paying banker to pay the money generally to a banker or to a particular banker, as the case may be, and not to pay to the holder across the counter.

A banker paying a crossed cheque over the counter will be liable to the customer if the holder turns out to be a person not entitled to pet payment. The object of crossing is to secure payment to a banker so that it could be traced to the person receiving the amount of the cheque.

There are two types of crossing – General and Special. To these may be added another type-Restrictive crossing.

A general crossing is one where a cheque bears across its face two transverse lines with or without the words “and company” or “& Co.” or two parallel transverse lines with or without the words “not negotiable”. If a cheque is crossed generally; the paying banker shall pay only to a banker.

Two parallel transverse lines with or without the words ‘& Co.’ across the face of

a cheque.

A special crossing is defined thus: “Where a cheque bears across its face an addition of the name of a banker, either with or without the word “not negotiable” that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially and to be crossed to that banker.” In a general crossing the parallel transverse lines are necessary although in a special crossing they need not be there. But in the later case, the name of the banker is essential to whom or to whose collecting agent alone the payment will be made.

Restrictive crossing have been adopted by commercial usage in order to obviate the risk of a their obtaining payment. They consist in addition to the general or special crossing the words ‘Account Payee’ only. Such crossing vvarn the collecting banker that the proceeds are to be credited only to the account of the payee, of the party named.

Parties to a Bill of Exchange

- The Drawer: the person who draws the bill.

- The Drawee: the person on whom the bill is drawn.

- The Acceptor: the person who accepts the bill. Generally, the drawee accepts the

bill, but stranger may accept on behalf of the drawee.

- The Payee: one to whom the sum stated in the bill is payable. Either the drawer or any other person may be the payee.

- The Holder is either the original payee or any other person to whom the payee has endorsed the bill. In case of the bearer bill, any bearer is the holder.

- The Endorser: when the holder indorses the bill to anyone else he becomes the

endorser.

- The Endorsee is the person to whom the bill is endorsed.

- Drawee in case of need: Besides the seven parties, another person called the drawee in case of need, may be introduced at the option of the drawer. The name of such a person is added to the bill so that when the bill is dishonoured either by non acceptance or by non-payment, the bill may be accepted or paid.

- Acceptor for Honour: a person who voluntarily becomes a party to a bill as an

acceptor to save the honour of the drawer at any indorser.

Parties to a Promissory Note

- The Maker: the person who makes or executes the note promising to pay the amount stated therein (Debtor).

- The Payee: one to whom the note is payable (Creditor).

- The Holder: is either the payee or some to whom he may have endorsed the note.

- The Endorser and Endorsees: Same as in the case of a bill.

Parties to a Cheque

- The Drawer: the person who draws the cheque.

- The Drawee is always the drawer’s banker on whom the cheque is drawn.

- The payee, Holder, Indorser and Indorsee: same as in the case of a bill of

Exchange or promissory note.

Holder and Holder in due course

A holder of negotiable instrument is a person who is entitled to be legally in possession of the instrument and to recover or receive the amount due thereon from the parties to the instrument (Sec.8). A person who has obtained possession of the instrument by illegal means, e.g. by theft, or under a forged indorsement, is not a holder. He cannot recover amount from the parties thereto.

A holder in due course is a person who obtained possession of the instrument for valuable consideration before its maturity, (i.e. before the amount mentioned in it becomes payable), and had no cause to believe that any defect existed in the title of the person from whom he derived title (Sec.9)

It follows from the above that a person is a holder in due course if:

(a) he has obtained the instrument for valuable consideration. Where the instrument is obtained by gift or by illegal means, the holder can not become a holder in due course.

(b) he has obtained the instrument complete and regular in all respects.

(c) he has become the holder before its maturity.

(d) he has obtained the instrument in good faith. Good faith simply means that a person takes the instrument without sufficient cause to believe that any defect existed in the title of the person from whom it is received. So where an instrument was torn into pieces and then pasted or the amount on the bill was erased, it should have arouse suspicion and the holder may not be called holder in due course.

Payment in due course

The payment of a negotiable instrument should be made to the right person by the payjng banker or the acceptor of the bill, otherwise the latter shall be responsible for the same. The payment of a negotiable instrument is not without certain risks. Thus, the Negotiable Instrument Act provides protection to the paying banker or the drawee of a bill, provided the payment is made as required in the Act. Such payment is called as payment in due course.

According to Section 10 “payment in due course” is payment in accordance with the apparent tenor of the instrument in good faith and without negligence to any person in possession thereof under circumstances which do not afford a reasonable ground for believing that he is not entitled to receive payment of the amount mentioned therein.

A payment in due course has the following essential features :

- The payment should be made according to the true intentions of the parties to the negotiable instrument, as is apparent from the document itself. Payment may be made either in cash or through a clearing house or by a draft. If the banker makes payment of a post-dated cheque before the date mentioned therein or pays a crossed cheque at the counter, then he acts against the true intentions of the drawer and hence the payment will not be treated as payment in due course.

- The payment should be made in good faith and without negligence. The banker

should made the payment in the good faith, i.e., honestly and not fraudulently. He

should take all necessary precautions and act as a reasonable person will act in the particular circumstances of a case.

- Payment must be made to the person in possession of the instrument in circumstances which do not arouse suspicion about his title to posses the instrument and receive payment thereof. The payment of the order cheque should be made to the right person after proper identification. Sometimes the appearance and behaviour of the person presenting the cheque at the counter may arouse a suspicion in the mind of the banker about the validity of the formers’ authority to receive payment.

Distinguish between holder and holder in due course:

| holder | holder in due course |

|

Holder means any person entitled in his own name to the possession of and to receive or recover the amount due thereon from the parties’ therto.but where a person finds a lost negotiable instrument or steals one he is not called a holder.

|

Holder in due course means any subsequent person who fulfills the following conditions: 1.for consideration he became the possessor of the instrument 2. he became a holder before maturity 3.he became holder in good faith but he will not be considered a holder in due course if he became one eother by fraud or by unlawful means. |

When a cheque must be dishonoured:

- the account holder is dead and the bank got notice to this effect

- when the customer has become insolvent

- When the customer issued stop payment notice.

- when the customer has given a notice to close the account

- when the customer has been declared insane

- When the banker suspects that the holder of the cheque has defective title.

When a cheque may be dishonoured:

- insufficient funds in the account of the holder

- the cheque is mutilated

- the cheque has become stale ( more than six months old)

- the cheque is materially altered

- the sign does not tally

- presented at a wrong branch

Negotiation and Assignment

Negotiation of an instrument is the process by which the ownership of an instrument is transferred from one person to another. According to Section 14 of the Act, when a note, bill or cheque is transferred to any person, so as to constitute that person the holder thereof, the instrument is said to be negotiated.

A negotiable instrument can also be transferred (by a separate deed of assignment); but in that case, the privileges of negotiation will not be available to the assignee, i.e., he will not enjoy the rights of a holder in due course.

The object of negotiation of instruments and their assignment is the same, i.e., the

transfer of ownership from one person to another but there are some points of distinction between the two which are as under :

Negotiation and Assignment Distinguished

| Negotiation | Assignment

|

| 1. Mere delivery in case of bearer

instrument and indorsement and delivery in case of an order instrument are sufficient to transfer title. |

1. A separate deed of assignment is essential.

|

| 2. Notice of transfer is not required to debtor. | 2. Notice of assignment must be given to the be the given to debtor. |

| 3. Consideration is presumed in case of negotiable instrument. | 3. Consideration must be proved by the assignee.

|

| 4. The transferee, as holder in due course may get a better title than his transferee.

|

4. The assignee gets only the right of transferor.

|

| 5. The Negotiable instrument Act deal with transfer of instrument by negotiable negotiation.

|

5. The Negotiable instrument Act does not deal with transfer of instruments by negotiation. |

How Negotiation is Effected

A negotiable instrument payable to bearer can be negotiated by mere delivery i.e., by merely handing over the instrument to the transferee, and no writing is necessary. When a negotiable instrument is payable to order, it is negotiated by the holder by indorsement and delivery. Endorsement or Indorsement means signature of the holder made with the object of transferring the insturment. Endorsement may be made on the back or face of the instrument.

If there is no space on the instrument the endorsement may be made on a slip of paper attached to it. Such a slip a called Allonge.

It will be noticed that delivery of the instrument to the transferee or his agent is essential of both the bearer and order instruments. Thus, where A endorses a bill in favour of B and puts it in his desk-drawer, there is no negotiation as the bill has not been delivered to B. If A dies and the bill is found by B in the drawer, B cannot sue on it, because the bill was never delivered by A to B.

Delivery of the instrument must be voluntary on the part of the holder and must be made with the intention of passing property in the instrument to the person to whom it is delivered.

So that a thief cannot get a good title to the instrument, nor can a finder of a lost instrument.

A negotiable instrument can be negotiated till payment or satisfaction. After payment or satisfaction it cannot be negotiated.

ENDORSEMENT

When the maker or holder of a negotiable instrument signs the same otherwise than as such make for the purpose of negotiation, on the face or back thereof, or a slip of paper annexed thereto called allonge or so sign for the same purpose a stamped paper intended to be completed as a negotiable instrument, he is said to endorse the same and is called as endorser. (Sec.15).

Requisities of valid endorsement

- It should be done on the instrument or allonge.

- It must be done by the maker/drawer/payee/holder/indorser of the instrument.

- It must be signed.

- Though no specific words are prescribed for endorsement yet the words used must clear the intention of the indorser to transfer the ownership of the instrument.

5.It must be completed by subsequent delivery of the instrument to the endorsee.

Once a Bearer Cheque, Always a Bearer Cheque

If a negotiable instrument is endorsed in blank or is payable to bearer, it is bearer

instrument. The holder may negotiate by mere delivery. But if the holder endorses it specially to a person and makes it payable to the order of such person, then the endorser in full cannot be sued by any person except the person in whose favour he endorsed it. But as regards all parties prior to the endorser in full, the instrument remains tranferable by mere delivery.

A, the payee of a bill, endorses it in blank and delivers it to B who endorses specially to C, or order C without any endorsement transfers it to D. D as the bearer is entitled to receive payment. In case of dishonour D is entitled to sue the drawer and the acceptor of the bill and also A and all indorsers prior to A, if any. He cannot, however, sue B or C.

Where a cheque is originally drawn payable to bearer, the drawee (the paying banker) is discharged by payment in due course to the bearer, even if there are any subsequent endorsement.

The rule is ‘once a bearer cheque always a bearer cheque’ which means that if a cheque is originally drawn payable to bearer, it remains bearer, even though it is subsequently endorsed in full. This rule is not applicable if a cheque originally made payable to order becomes payable to bearer by blank endorsement.

Where a, bearer negotiates an instrument by mere delivery, and does not put his signature thereon, he is not liable to any party to the instrument in case it is dishonoured as he has not lent his credit to it.

Presentment

Presentment is made for two purposes :

(i) Presentment for acceptance and,

(ii) Presentment for payment.

Only bill of exchange of certain kinds require presentment for acceptance. Bills payable demand or at sight need not be presented. But the following bills must be presented for acceptance, otherwise the parties to the bill will be liable on it.

- A bill payable after sight. Presentment is necessary in order to fix maturity of the

bill.

- A bill in which there is an express stipulation that it shall be presented for acceptance before it is presented for payment.

But even in cases where presentment is optional, it is desirable to get it accepted as soon as possible. The bill must be presented for acceptance before the date of payment and within a reasonable time after it is drawn. The drawee can take 48 hours to accept it, but after 48 hours are over he must return the bill to the holder with or without acceptance. If the holder allows the drawee more than 48 hours to decide whether to accept or not, all prior parties to the bill are discharged from their liabilities under the bill.

If the drawee, after a reasonable search, cannot be found, the bill can be treated dishonoured.

If a bill is directed to the drawee at a particular place, it must be presented at that place. If a bill, which requires acceptance, is not presented for acceptance; the drawer and all endorsees are discharged from their liability to the holder.

When presentment for acceptance not necessary

- When after a reasonable search the drawee cannot be found.

- When the bill is drawn on a fictitious person or on a person who is incapable of

entering into contracts.

- When the drawee is insolvent or dead.

- Where, although the presentment is irregular, acceptance has been refused on some other ground.

Presentment for payment

The negotiable instrument must be presented for payment. The rule regarding presentment for payment are as follows :

- Promissory notes, bills of exchange and cheques must be presented for payment to the maker, acceptor or drawee thereof respectively, by or on behalf of the holder. If default in presentment is made no party other than the maker, acceptor or drawee will be liable to the holder.

- A pronote, payable at a certain period after sight, must be presented to the maker by a person who is entitled to demand payment, within a reasonable time after it is made and during business hours on a business day. If presentment is not made, no party there to is liable on it to the person failing to present.

- Where a pronote is payable on demand and is not payable at a specified place, no presentment is necessary.

- A pronote or bill made payable at a specified period after date or sight, must be

presented for payment at maturity.

- A note or bill made, drawn or accepted payable at a specified place must be presented for payment at that place otherwise the maker or the drawer will be liable on it.

- A note, bill or cheque made, accepted or drawn payable at “Specified place and not elsewhere” must be presented at that place, otherwise no party to it will be liable.

- A pronate payable by instalments must be presented for payment on the third day after the date fixed for each installment.

- A note or bill not made payable at a specified place must be presented for payment at the place of business, if any or at the usual residence, of the maker, drawee or acceptor thereof, as the case may be.

- A cheque must be presented at the bank upon which it is drawn before the relation between the drawer and his banker has been altered to the prejudice of the drawer. If default is made the drawer be discharged from liability.

- If the cheque is not presented to the banker for payment within a reasonable time, then all parties other than the drawer will be discharged.

Delay in presentment for acceptance or payment is excused, if it is caused by circumstances beyond the control of the holder.

Presentment for payment not necessary: Presentment for payment is not necessary in the following cases. In all such cases the instrument is deemed to be dishonoured at the due date so presentment for payment is not necessary:

- If the maker, drawee or acceptor intentionally prevent presentment of the instrument.

- If the instrument being payable at his place of business, he closes such place on a business day during the usual business hours.

- If the instrument being payable at some other specified place, neither he nor any

other person authorised to pay it attends at such place during the usual business

hours.

- If the instrument is not payable at a specified place and the drawer or acceptor,

cannot, after due search, be found.

- Where there is no promise to pay notwithstanding non-presentment.

- Where the presentment is waived by the party entitled to presentment becomes

impossible because of impossibility or illegality or performance.

- Where the drawer could not possibly have suffered any damage by non-presentment.

- Where the drawee is a fictitious person, or one incompetent to contract.

- Where the bill has been dishonoured by non-acceptance.

- Where the terms of agreement do not require any presentment for the instrument.

In all the above cases no presentment for payment is necessary and the instrument is deemed to be dishonoured at the due date.

DISHONOUR

A bill of exchange may be dishonoured either by non-acceptance or by non-payment. A pronote or cheque is dishonoured by non-payment as acceptance is not required in their case.

When an instrument is dishonoured the holder must give notice of dishonour to the

drawer or maker or his previous holders if he wants to make them liable.

Dishonour of a bill by non-acceptance (Sec.91) : A bill is said to be dishonoured by not acceptance when :

- the drawee does not accept it within 48 hours from the time of presentment for

acceptance;

- presentment for acceptance as excused and the bill remains unaccepted;

- the drawee is incompetent to contract;

- the drawee is a fictitious person;

- the drawee, after a reasonable search, cannot be found; and

- the acceptance is qualified and the holder opts to treat it as dishonoured.

Dishonour of an instrument by non-payment (Sec. 92) : A promissory note, a bill of exchange or cheque IS said to be dishonoured by non-payment when the maker of the note, acceptor of the bill or drawee banker of the cheque makes default in payment on being duly required to pay the same.

A negotiable instrument is also deemed to be dishonoured by non-payment when presentment for payment is excused and the instrument remains unpaid on maturity; and instrument when overdue, remains unpaid.

Effect of Dishonour : The drawer and all the endorsers of the bill are liable to the holder if the bill is dishonoured either by the non-acceptance or by the non-payments provided the he gives them notice of dishonour. The drawee is liable only when there is dishonour by non payment.

Consequence of failure to give notice: Any person to whom notice of dishonour is not given is discharged from his obligations under the instrument. He is not liable to pay and no suit can be filed against him.