Foreign exchange Market:

Foreign exchange is also known as “Forex”.

According to Kindleberger, “the foreign exchange market is a place where foreign moneys are bought and sold”. Foreign exchange market is an institutional arrangement for buying and selling of foreign currencies Exporters sell the foreign currencies. Importers buy them.

Participants in Foreign Exchange Market

The major participants in the foreign exchange market are the large commercial banks; foreign

exchange brokers in the interbank market; commercial customers, customers, primarily multinational corporations; and central banks, which intervene in the market from time to time to smooth exchange rate fluctuations or to maintain, target exchange rates

Rate of Exchange

“Rate of exchange” between any two currencies is the rate at which they are exchanged or sold against each other.

An exchange rate is the price of a currency. It is the number of units of one currency that buys one unit of another currency, and this number can change daily.

The rate at which the currencies of two nations are exchanged for each other is called the rate of exchange.

1 dollar – 66.96 rupees

1 pound- 95.46 rupees

1 euro – 75.36 rupees

1 kuwaiti dinar- 238.75 rupees

For example, if 1 U.S. dollar is exchanged for Rs.66.96 then foreign exchange rate is. 1 U.S. $ = Rs.66.96. In other words, the rate of exchange is nothing but the value or price of a country’s currency expressed in terms of a foreign currency.

Determinant of foreign Exchange

- Interest Rate

Whenever there is an increase interest rates in domestic market there will be increase investment funds causing a decrease in demand for foreign currency and an increase in supply of foreign currency.

- Inflation Rate

when inflation increases there will be less demand for local goods (decreased supply of foreign currency) and more demand for foreign goods (increased demand for foreign currency).

- Government budget deficit or surplus

The market usually react negatively to widening govt. budget deficits and positively to narrowing budget deficits. This will result in change in the value of countries currency.

- Political conditions

Political stability of a country can help very much to maintain a high exchange rate for its currency; for it attracts foreign capital which causes the foreign exchange rate to move in its favor. Political instability, on the other hand, causes a. panic flight of capital from the country, hence the home currency depreciates in the eyes of foreigners and consequently, its exchange value falls.

FOREIGN EXCHANGE RATE

- It is the rate at which one currency will be exchanged for another in foreign exchange.

- It is also regarded as the value of one country’s currency in terms of another currency.

There are three basic types;

- Fixed rate

- Floating rate

- Managed rate

FIXED EXCHANGE RATE

- It is the system of following a fixed rate for converting currencies.

- In this system, the government (or the central bank acting on its behalf) intervenes in the currency market in order to keep the exchange rate close to a fixed target.

- It does not allow major fluctuations from the central rate.

Advantages

- It provide the stability of exchange rate.

- Fixed rates provide greater certainty for exporters and importers.

Disadvantages

- Too rigid to take care of major upheavals.

- Need large reserves to defend the fixed exchange rate.

- May cause destabilizing speculations; most currency crisis took place under a fixed exchange system.

FLOATING/FLEXIBLE EXCHANGE RATE

- Under the flexible exchange rate system, the rate of exchange is allowed to vary to suit the economic policies of the government.

- Flexible exchange rates are exchange rates, which fluctuate according to market forces.

The value of the currency is determined solely by the forces of demand and supply in the exchange market.(self correcting mechanism

Advantages

- Automatic adjustmentfor countries with a large balance of payments deficit.

- Flexibility in determining interest rates

- Allow countries to maintain independent economic policies.

- Permit a smooth adjustment to external shocks.

- Don’t need to maintain large international reserves.

Disadvantages

- Flexible exchange rates are highly unstable so that flows of foreign trade and investment may be discouraged.

- They are inherently inflationary.

MANAGED EXCHANGE RATE

- Managed exchange rate systems permit the government to place some influence on an exchange rate that would otherwise be freely floating.

- Managed means the exchange rate system has attributes of both systems.

- Through such official interventions it is possible to manage both fixed and floating exchange rates.

Determination of the Rate of Exchange/Theories of Exchange rate

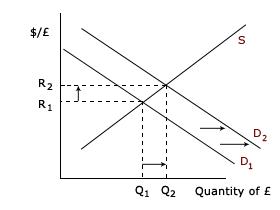

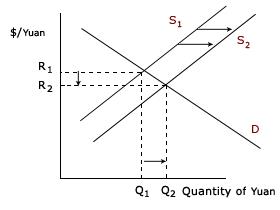

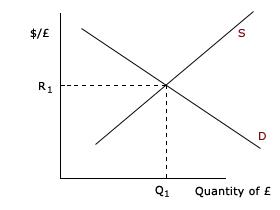

The rate of exchange in the foreign exchange market will be determined by the interaction between the demand for foreign exchange and the supply of foreign exchange

- Therefore, if for some reason people increase their demand for a specific currency, then the price will rise provided that the supply remains stable.

- On the contrary, if the supply is increased the price will decline and it is provided that the demand remains stable.

Equilibrium rate of exchange is determined at a point where demand for foreign exchange equals its supply:

Purchasing Power Parity Theory (PPP Theory)

“According to PPP theory, when exchange rates are of a fluctuating nature, the rate of exchange between two currencies in the long run will be fixed by their respective purchasing powers in their own nations.”

- e the price of a good that is charged in one country should be equal to the one charged for the same good in another country, being exchanged at the current rate.

- This rule is also known as the law of one price.

- It is an economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency’s purchasing power.

Balance of Payments Theory

- According to the Balance of Payments Theory, also known as the Demand and Supply Theory of exchange rate, the foreign exchange rate, under free market conditions, is determined by the demand and supply conditions in the foreign exchange market. Thus, according to this theory, the price of a currency, i.e., the exchange rate, is determined in the same way in which the price of any commodity is determined by the free play of the forces of demand and supply.

- The balance of payments approach is another method that explains what the factors are that determine the supply and demand curves of a country’s currency.

- According to the theory, a deficit in the balance of payments leads to fall or depreciation in the rate of exchange, while a surplus in the balance of payments strengthens the foreign exchange reserves, causing an appreciation in the price of home currency in terms of foreign currency. A deficit balance of payments of a country implies that demand for foreign exchange is exceeding its supply.

- As a result, the price of foreign money in terms of domestic currency must rise, i.e., the exchange rate of domestic currency must fall. On the other hand, a surplus in the balance of payments of the country implies a greater demand for home currency in a foreign country than the available supply. As a result, the price of home currency in terms of foreign money rises, i.e., the rate of exchange improves.

Structure of the Indian Foreign Exchange Market

The foreign exchange market in India consists of three segments or tiers. The first consists of transactions between the Reserve Bank of India (RBI) and the Authorized Dealers (ADs). The latter are mostly commercial bank. The second segment is the inter-bank market in which the ADs deal with each other, and the third segment consists of transactions between ADs and their corporate customers. The retail market in currency notes and travelers’ cheques caters to tourists. In the retail segment, in addition, to the ADs, there are Money Changers, who are allowed to deal in foreign currencies.