International Banking reserve

The world’s banking system plays a vital role in facilitating international transactions and maintaining economic prosperity. Commercial banks, such as Citicorp, help finance trade and investment and provide loans to international borrowers. Central banks, such as the Federal Reserve, serve as a lender of last resort to commercial banks and sometimes intervene in foreign-currency markets to stabilize

currency values. Also, the International Monetary Fund (IMF) serves as a lender to nations having deficits in their balance of payments.

International reserve is any kind of reserve funds that can be passed between the central banks of different countries. International reserves are an acceptable form of payment between these banks. The reserves themselves can either be gold or else a specific currency, such as the dollar or euro.

International banking plays a vital role in world financial market to provide loan to international borrower.

Just as an individual desires to hold cash balances, national governments have a need for international reserves. The chief purpose of international reserves is to enable nations to finance disequilibrium in their balance-of-payments positions.

When a nation finds its monetary receipts falling short of its monetary payments, the deficit is settled with international reserves. Eventually, the deficit must be eliminated, because central banks tend to have limited stocks of reserves.

Demand for International Reserves dependent on:

- monetary value of international transactions

- disequilibrium that can arise in balance of payment positions

- speed and strength of balance of payments adjustment mechanisms

- institutional framework of the world economy

In theory there would be no need for international reserves with freely floating exchange rates.

The supply of international reserves

The supply of international reserves consists of owned and borrowed reserves. Among the

major sources of own reserves are (a) foreign currencies, (b) monetary gold stocks, (c) special drawing rights, and major source of Borrowed Reserves are foreign nations, foreign financial institutions ,international agencies

Special Drawing Rights ( SDR)

The liquidity and confidence problems of the gold exchange standard that resulted from reliance on the dollar and gold as international monies led in 1970 to the creation by the IMF of a new reserve asset, termed special drawing rights. The objective was to introduce into the payments mechanism a new type of international money, in addition to the dollar and gold, that could be transferred among participating

nations in settlement of payments deficits. With the IMF managing the stock of SDRs, world reserves would presumably grow in line with world commerce.

Today, the SDR has only limited use as a reserve asset, and its main function is to serve as the unit of account of the IMF and some other international organizations. Also, some of the IMF’s member nations peg their currency values to the SDR. Rather than being an international currency, the SDR is a potential claim on the freely usable currencies of IMF members. Holders of SDRs can obtain these currencies in exchange for their SDRs.

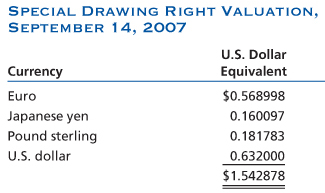

The value of the SDR is defined as a basket of currencies that includes the U.S.dollar, Japanese yen, UK pound, and the euro. The weights of the currencies reflect the amount of exports and imports of these countries during the previous five years. As of 2009, the weights in the basket were: the U.S. dollar — 44 percent, the euro — 34 percent, the yen = 11 percent, and the pound = 11 percent. The SDR’s basket

composition is reviewed every five years to ensure that it reflects the relative importance of currencies in the world’s trading and financial systems. The latest value of the SDR can be found on the IMF’s Web site, which is updated daily.